Rental property accounting software that does the tedious work for you. Auto-categorize transactions, generate Schedule E reports, and track depreciation—without the manual entry nightmare. Choose self-service automation or let our team handle everything.

Stop Manual EntryIncluded in Self-Service

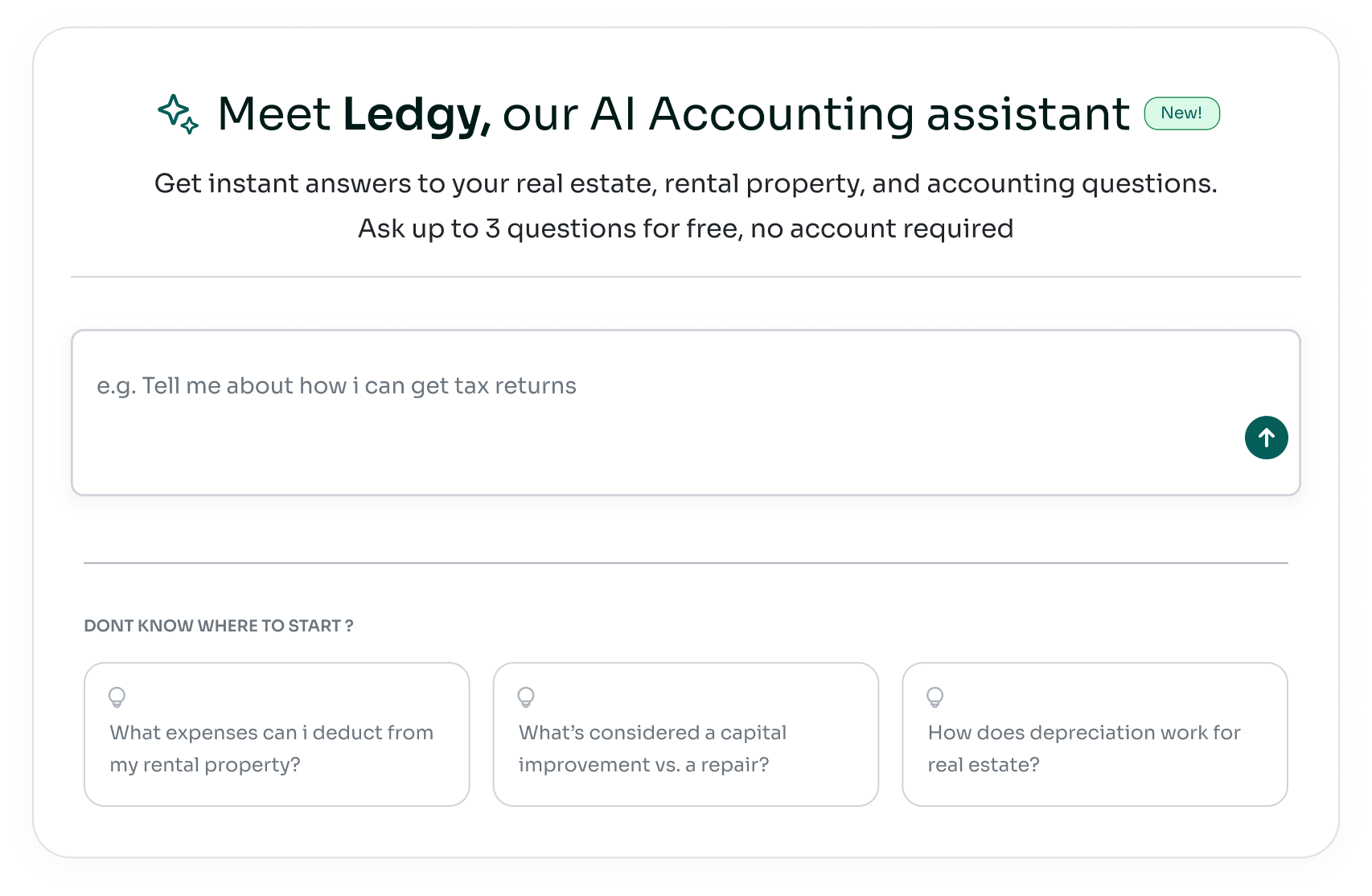

Your CPA takes days to respond. Ledgre's AI CPA answers rental property tax questions instantly—trained on IRS Schedule E, Form 8825, depreciation rules, and real estate deductions.

Full-Service Plan

Don't want to touch your books at all? Our Full-Service plan means a dedicated bookkeeper handles everything—importing, categorizing, reconciling, and preparing your Schedule E. You relax.

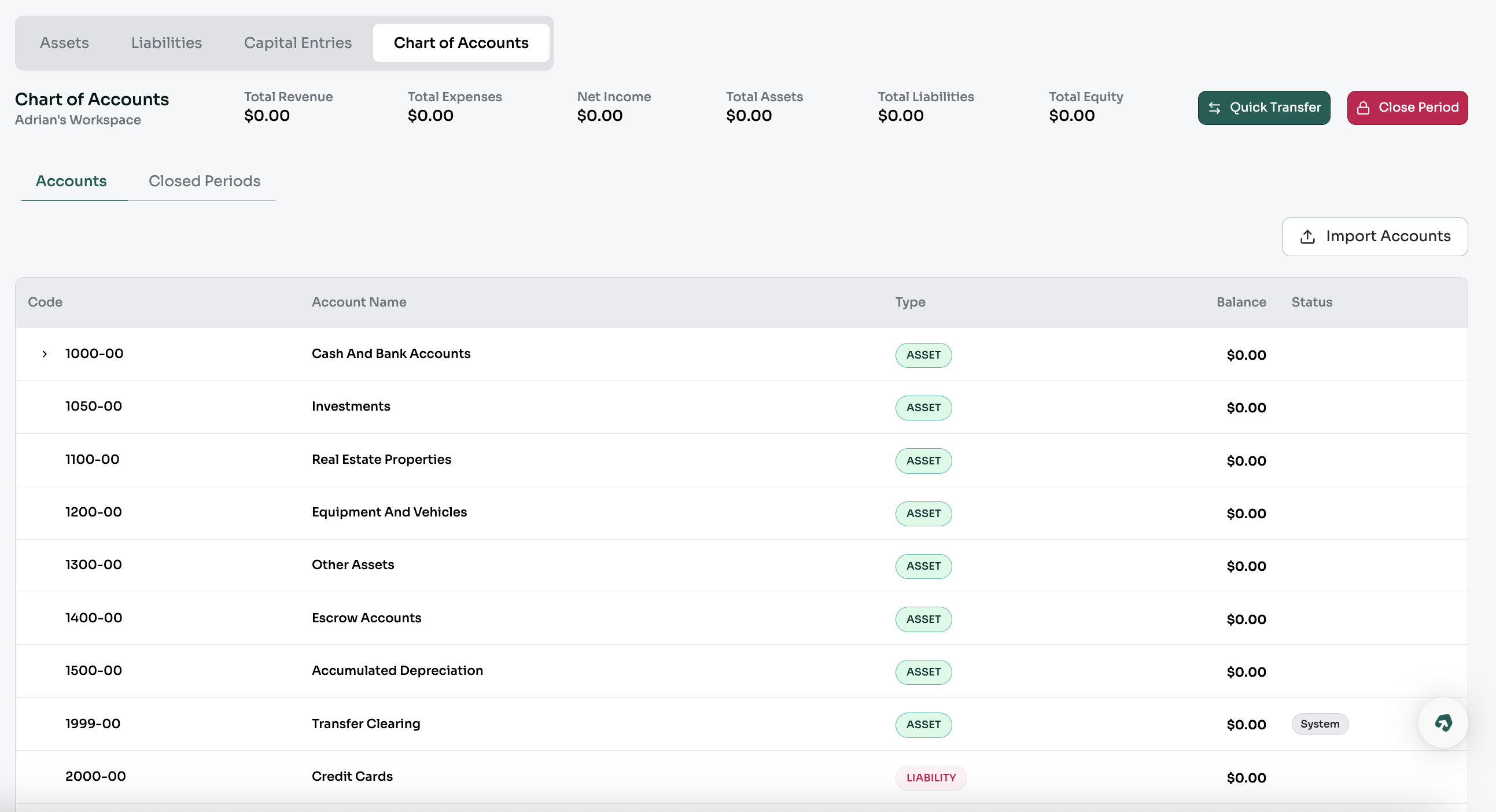

Messy books cause audit anxiety. Ledgre uses real double-entry accounting—the same standard CPAs expect—so your books are always audit-ready. No accounting degree required.

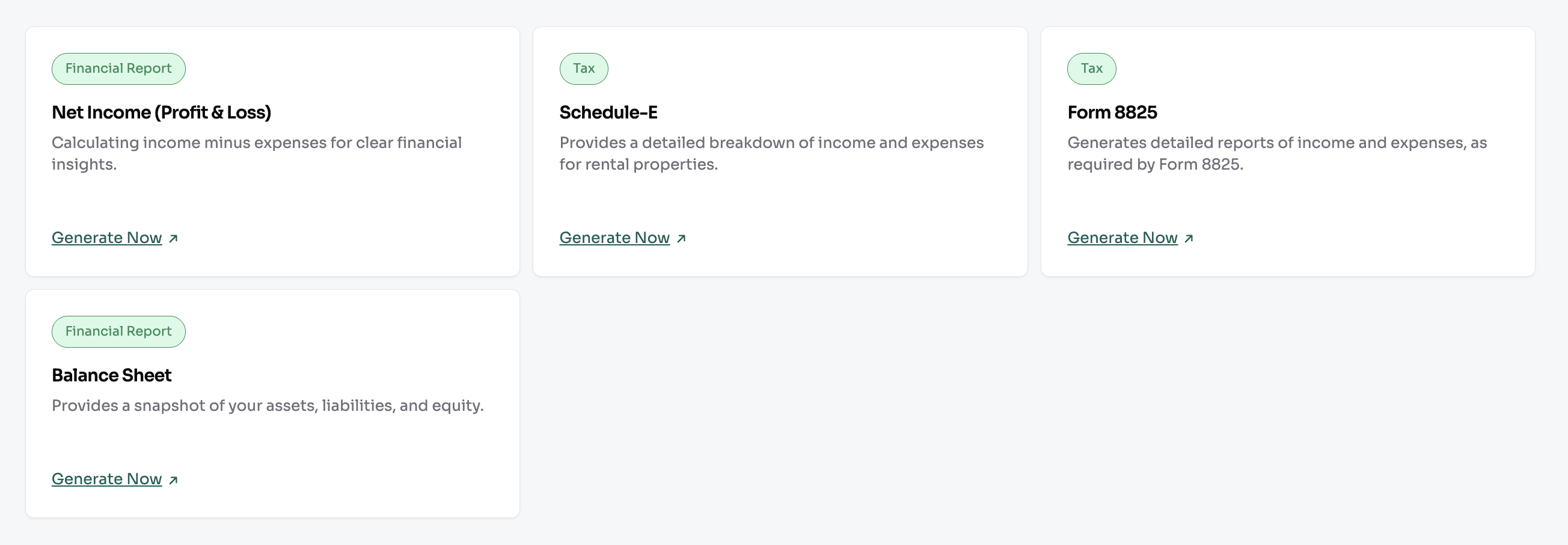

No more scrambling to find receipts or calculate depreciation by hand. Ledgre tracks depreciation automatically and generates Schedule E, Form 8825, and P&L reports with one click. Your CPA gets exactly what they need.

Stop guessing if your rentals are profitable. Get P&L statements, cash flow tracking, and expense breakdowns by property—without hiring a bookkeeper.

Self-Service Feature

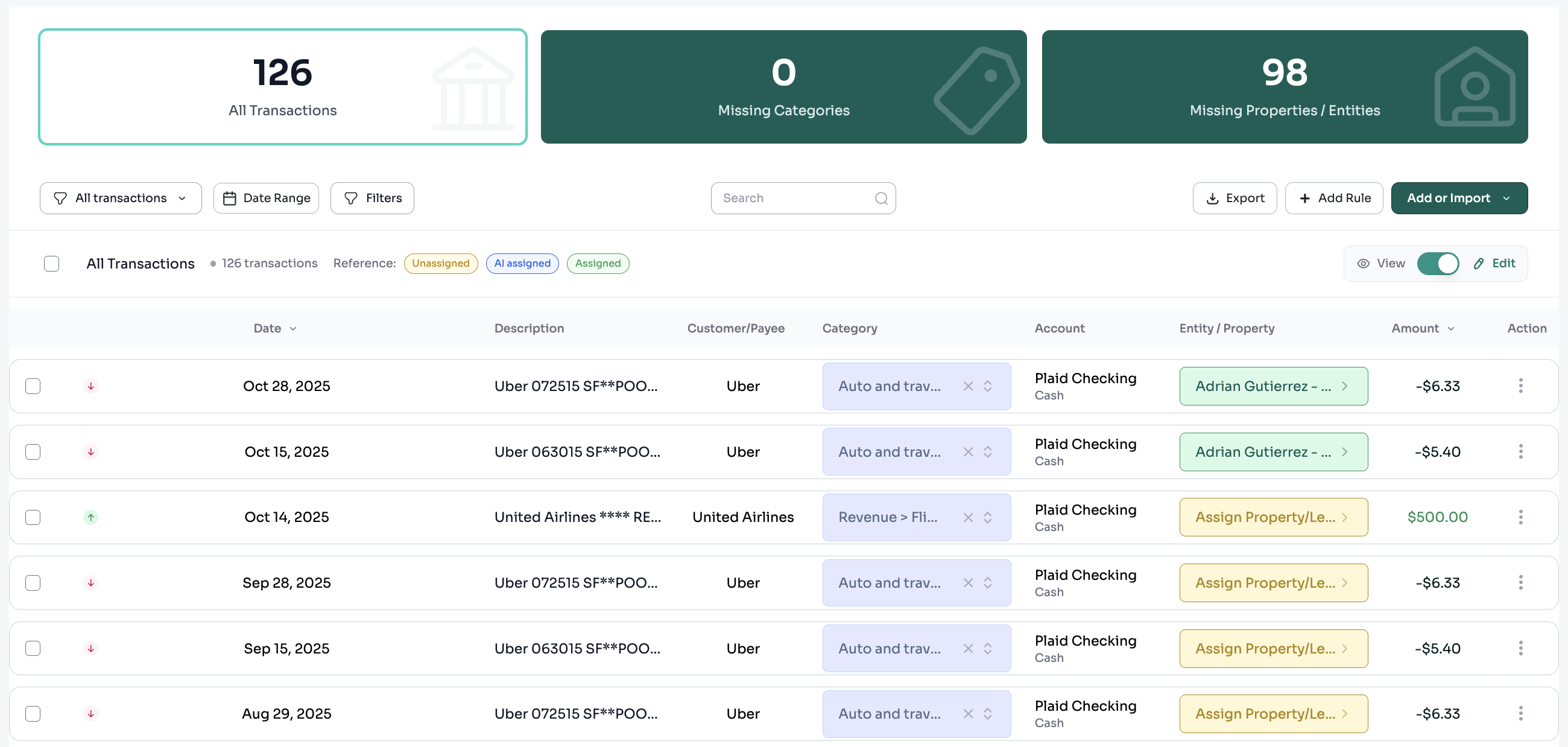

Manual entry is soul-crushing. Connect your accounts once—Ledgre auto-imports and categorizes every transaction. The AI learns your patterns, so it gets smarter over time.

Other software charges per property. Ledgre doesn't. Manage unlimited properties, entities, and units from one dashboard. No per-property fees, ever.

Stop wondering if a property is actually profitable. Track every rent payment, maintenance expense, and utility bill—organized by property, ready for taxes.

No more copying data between systems. Connect your bank accounts, property management software, and export anywhere—all automated.

Other software charges per user. Ledgre doesn't. Invite your CPA, property manager, business partners—anyone who needs access. Unlimited users included.

Bank-level encryption protects your financial data. And unlike some platforms, you can export or delete everything anytime—no hostage situations.

Choose how much help you want: automate your landlord bookkeeping yourself, or let our team handle everything.

Self-Service

AI does the work, you stay in control

Full-Service

We do the work, you relax