Key Benefits of Tax Preparation with Ledgre

Detailed Records

Organization is your best friend when it comes to taxes. Receipt uploads and detailed transaction logs help you stay compliant with IRS requirements.

Multi-User Access

Manage multiple users within the software and get proper access to those who need it.

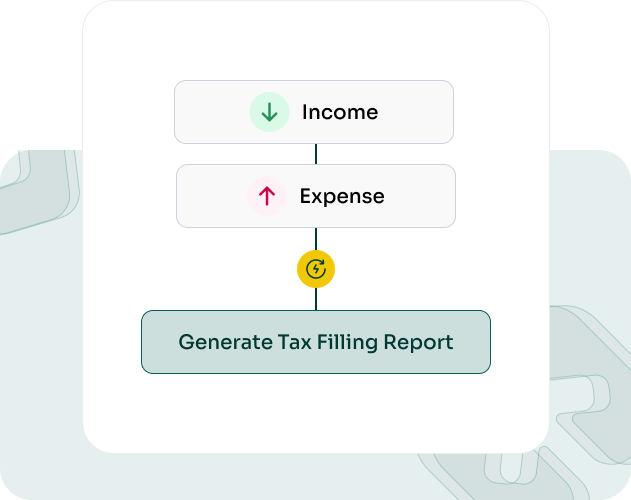

Stress-Free Tax Season

Generate real-estate specific tax reports with organized financial data, saving you valuable time during tax season.

How Ledgre Simplifies Tax Preparation for You

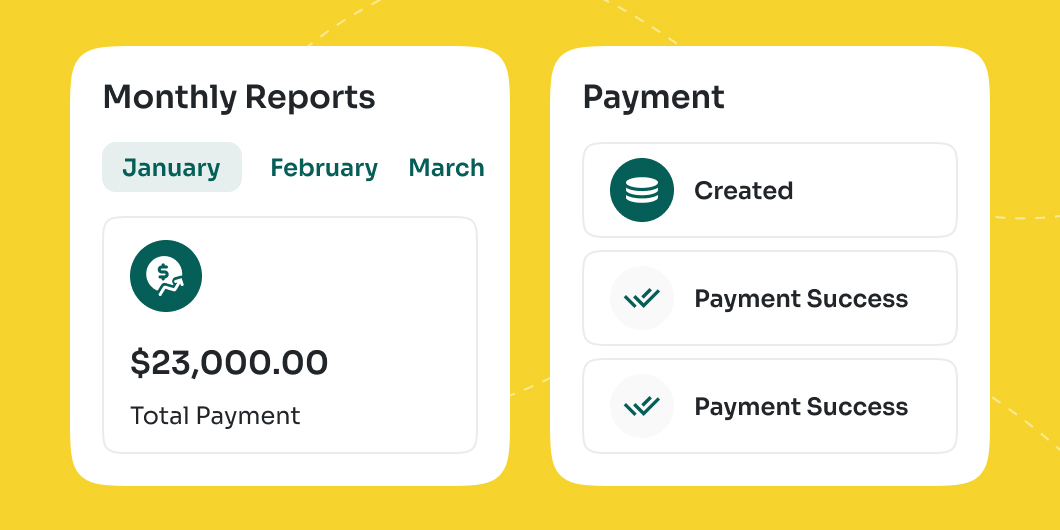

Accurate Income and Expense Tracking

Cash Basis accounting ensures that income is recognized only when received, and expenses are recorded only when paid. This mirrors the investor's actual cash flow, simplifying tax reporting and minimizing errors in taxable income calculations.

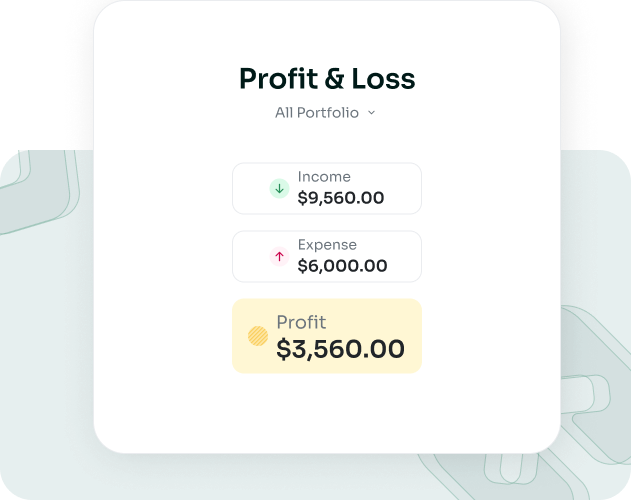

Efficient Deduction Management

Ledgre allows you to categorize and track tax-deductible expenses such as repairs, property management fees, and mortgage interest. Organized records make it easy to maximize deductions without missing any qualifying expenses.

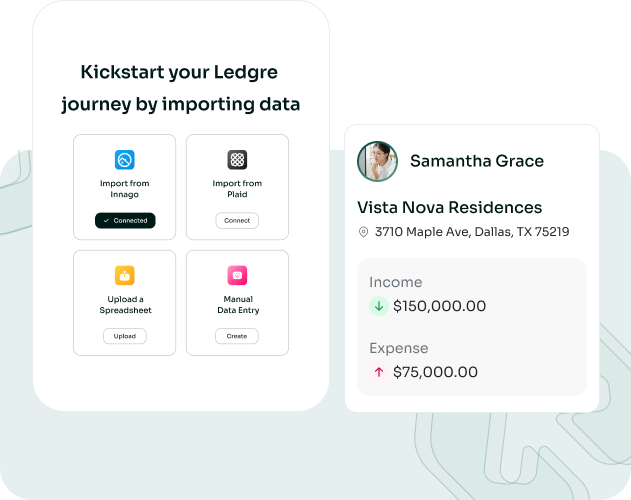

Simplified Record-Keeping for IRS Compliance

Investors can maintain clear, audit-ready records. Features like receipt uploads and detailed transaction logs reduce the risk of non-compliance with IRS requirements for real estate activities.

Tailored Reporting for Real Estate Tax Strategies

Ledgre can generate real estate-specific tax reports, such as Schedule E and Form 8825. This capability simplifies tax filing and enables strategic planning like timing expenses or income to optimize tax liabilities.

Save Time and Avoid Stress During Tax Season

By keeping everything organized throughout the year, Ledgre reduces the year-end scramble to gather documents. This streamlining makes filing taxes faster and less stressful, especially for investors managing multiple properties.

Start Managing Your Finances Like a Pro

Take the guesswork out of accounting. Sign up for Ledgre today and experience the difference automated financial reporting can make for your rental business.

How we stand out!

Expert Support

Our team of property investment specialists is here to guide you at every step, ensuring your reports are accurate and actionable.

Cutting-Edge Technology

We combine advanced reporting tools with a user-friendly interface for a seamless experience.